If you fall behind with your council tax payments, we may send you a text or email before taking further action.

This service can delay recovery notices from being sent out and may help you avoid paying expensive costs.

Although this service is offered to prevent you from falling further into arrears, it should not be relied upon.

Keeping up to date with your payments is your responsibility. Failure to do so may result in recovery action being taken.

Checking a message is genuine

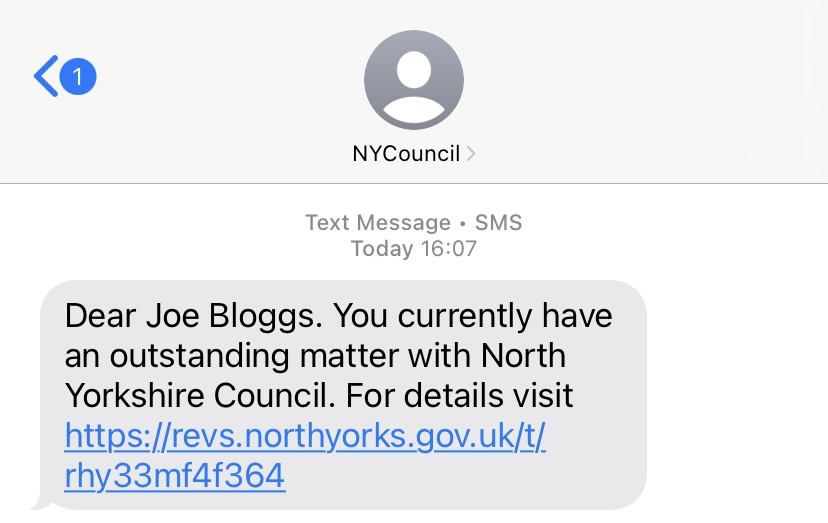

You will receive a text message that says:

"Dear (your name here). You currently have an outstanding matter with North Yorkshire Council. For details visit (link here). Please do not ignore this message"

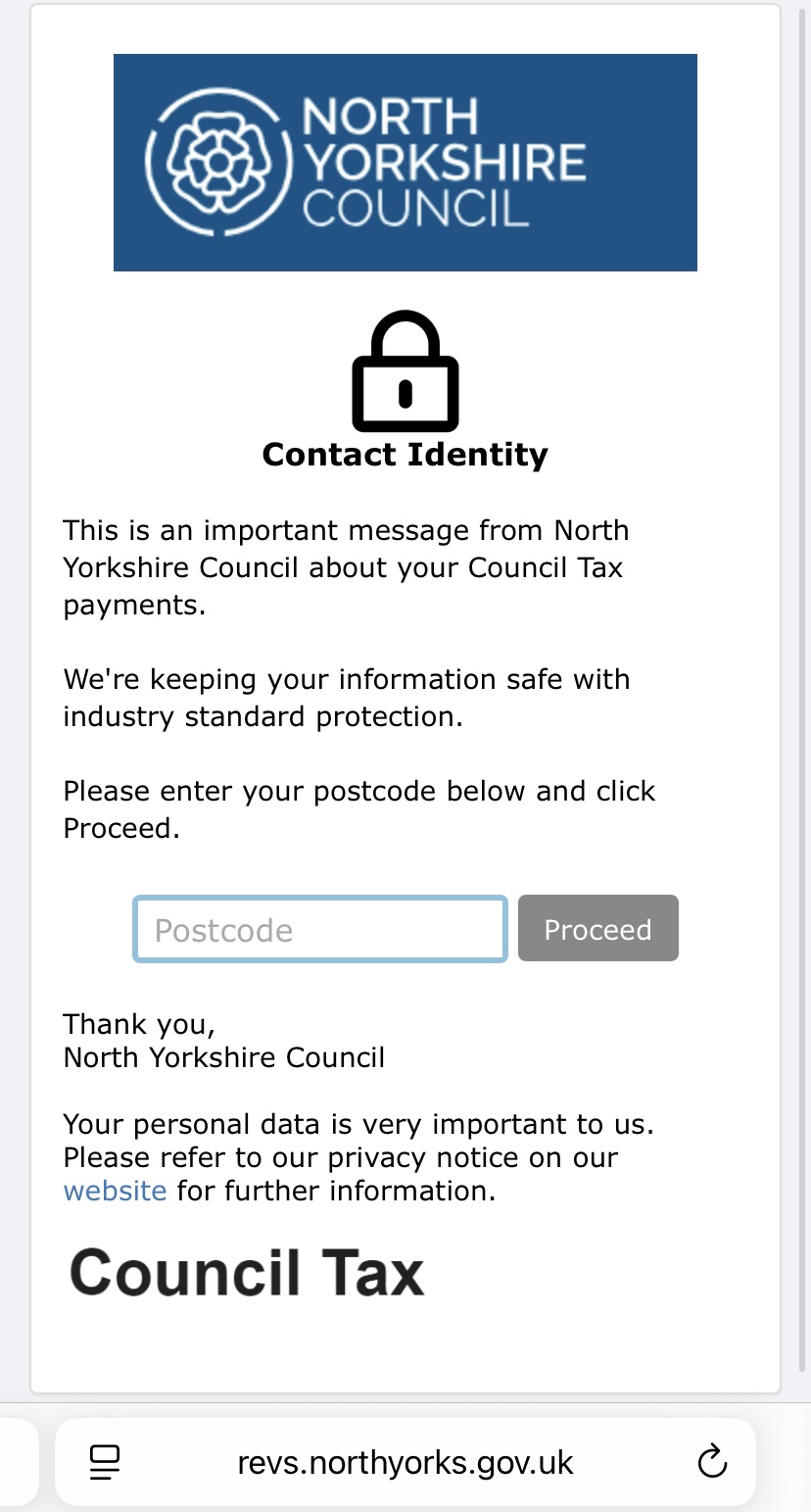

The link will take you to the verification screen, where you will be asked to verify your postcode.

Once you click the link, you will be taken to a contact identity page where you will need to enter your postcode.

When you have entered a valid postcode and clicked proceed, you will be directed to the content of the message.

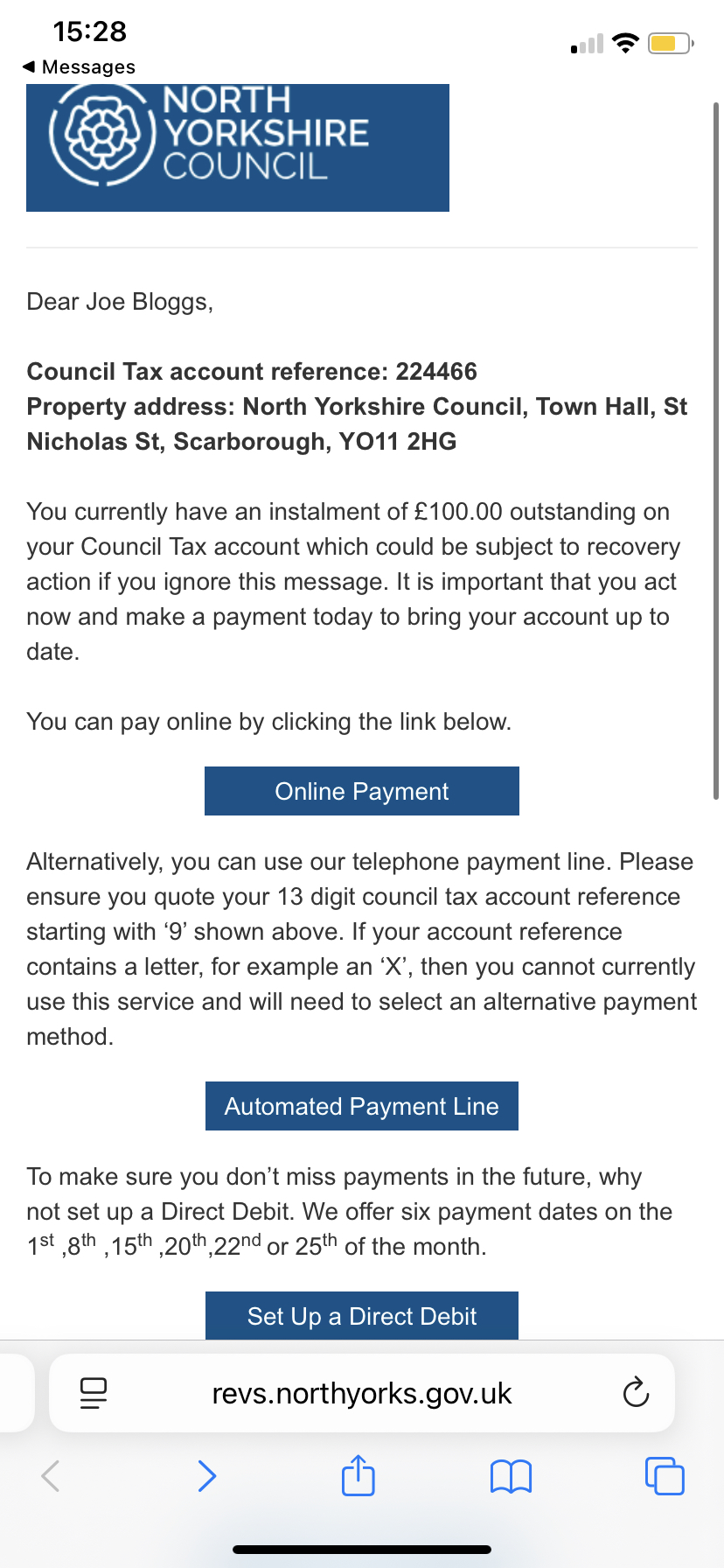

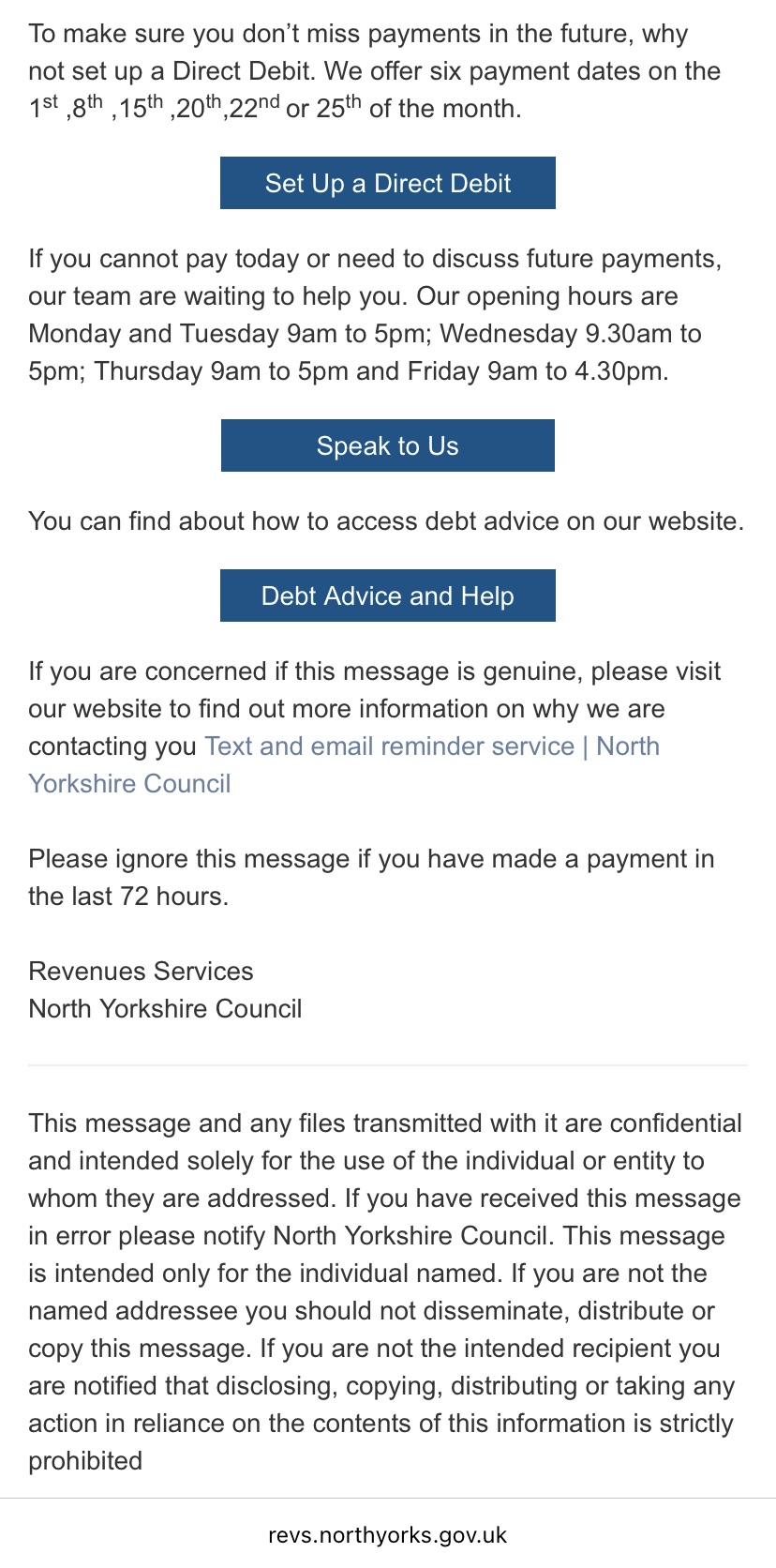

This will let you know the amount that is overdue. It will provide you with links so you can make payment either over the phone or on our website. You also have the option to set up a direct debit should you want one.

Email Reminder

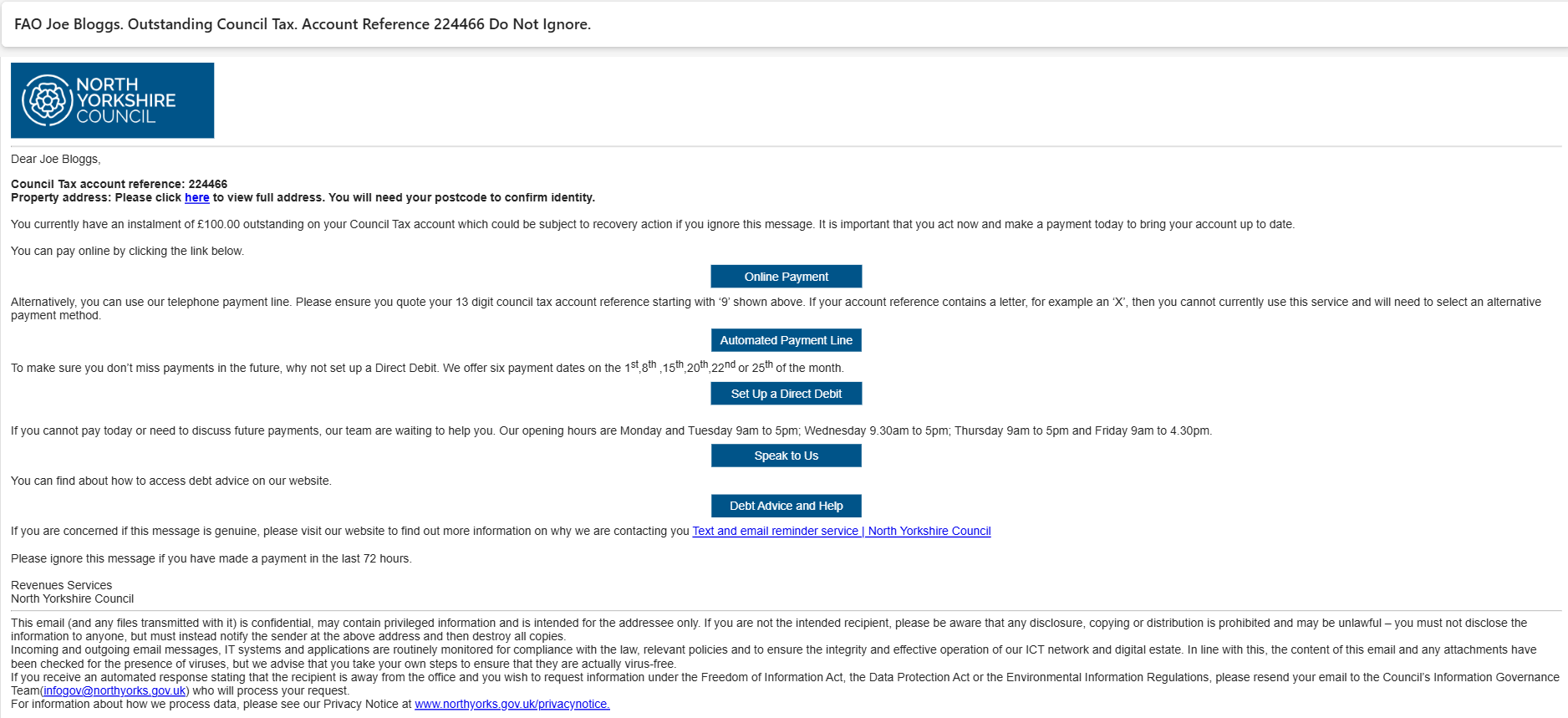

If you receive an email reminder about your Council Tax, it will look like the image below. For security purposes, the full property address is not displayed. To reveal the property address, just click on the “here” URL and enter your postcode. The property address will be revealed once you have entered a valid postcode.

Council tax reduction scheme

If you struggling to pay your council tax bill and are on a low income or claim benefits, you can apply for a reduction in the council tax you pay. Find more information on our council tax reduction scheme page.